Washington, D.C. (May 1, 2024): On May 1st President Biden announced May is Physical Fitness and Sports Month and highlighted the cost and access barriers to activity many Americans face.

“Today, less than half of all Americans live within a half-mile of a park. Tens of millions of children do not have access to a playground within a 10-minute walk of their home. Cash-strapped schools are too often cutting physical education programs. Youth sports leagues can be expensive, leaving too many kids with few options. The United States of America can do better.”

The Sports & Fitness Industry Association applauds the Administration’s commitment to active lifestyles and recognition of the barriers to healthy activity. SFIA is working to move two policies through Congress to address the cost and access barriers. The PHIT Act will lower costs of activity by allowing consumers to use funds in pre-tax medical accounts to pay for them. PHIT is a tax bill, and more than half of the members of the top Congressional tax committee are co-sponsors of the legislation. The Youth Sports Facility Act is draft legislation to expand the definition for eligible uses of Economic Development Assistance (EDA) grants to include youth sports and recreation projects. EDA received $468 million in funding in 2024 but none of the money flowed to youth sports & recreation projects.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (April 18, 2024): The Generalized System of Preferences (GSP) tariff relief program got a boost when the House Ways & Means Committee passed legislation to renew the program through 2030 and offer retroactive relief from January 1, 2021 when the program lapsed. Companies would have 180 days to file for retroactive relief.

The bill would also ban China from being eligible for GSP benefits to help level the playing field. There are currently 119 GSP-eligible countries and industry products made in GSP countries; the bill includes labor and environmental provisions for eligibility. Democrats were disappointed an amendment to renew the Trade Adjustment Assistance (TAA) program to help displaced workers failed.

The Ways & Means Committee also approved legislation to ban any goods subject to Section 301 enforcement tariffs from using the de minimis exemption that allows shipments valued under $800 to ship direct to consumer. Shipments from China accounted for two-thirds of de minimis shipment 2018-2021 according to the U.S. International Trade Commission.

Chinese e-commerce giants Temu and Shein use de minimis to avoid CBP inspections for counterfeits, forced labor, and applicable tariffs. Use of the de minimis exemption soared from $40 million in 2012 to $67 billion in 2022 as bad actors abused the loophole to circumvent U.S. Customs to avoid Section 301 tariffs and bring in illegal products.

“SFIA applauds this action in the House of Representatives – it is a step in the right direction on GSP and reeling in the abuse of a tariff loophole,” said Bill Sells, SVP, Government & Public Affairs, SFIA. “GSP will make alternative sourcing options more attractive to SFIA members seeking to move out of China; tightening the use of the de minimis exemption will limit fakes and level the tariff playing field. We look forward to moving this bill through Congress.”

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (April 3, 2024): As shipping companies and manufacturers scramble to mitigate the supply chain issues resulting from the tragic collapse of the Francis Scott Key Bridge, blocking the entrance to the Baltimore Harbour, the CBP, and the United Command overseeing the response have provided information to help manufacturers, importers/exporters, and shippers.

The CBP issued an update on the Baltimore Port Closure due to the collapse of the Francis Scott Key Bridge offering guidance on alternative Port options, cargo stranded in Baltimore Port, and unloading export cargo from ships in Baltimore Port. A “United Command” website has been created to provide the latest information on the response and the impact on the Port to aid interested parties in navigating the challenges presented by the bridge collapse.

President Biden has committed Federal Government resources and funding for the removal of the debris and reconstruction of the Key Bridge. Congress needs to waive the requirement that the State cover a portion of the expense and approve the Federal Government paying 100 percent of the costs. Some in Congress have raised concerns about the Federal Government covering the entire project, but there is enough support to re-open this major East Coast Port quickly to pass legislation funding the clean-up/reconstruction of the bridge.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

2024 Quarter 1 Recap

While election-year politics hang over Congress, there is hope for tariff relief & health promotion policies. With the Presidential race getting the headlines, Congress navigates the choppy waters of an election year to find common ground. Divisions in Congress may get all the attention, but there are Members committed to finding bipartisan solutions, however, the path to success is narrow in a highly contentious election year.

If 2023 is any indication of what to expect in 2024 it will be a challenge, as only 27 bills were signed into law last year and 2024 will be more volatile due to the Presidential election. Despite the challenges presented by Presidential election year politics, SFIA policy priorities cut across party lines.

With the COVID-19 pandemic behind us, Congress has moved on to recovery. The economy remains sluggish and consumer prices continue to rise. SFIA advocacy has targeted policies to lower consumer costs, create more resilient supply chains, protect IPR, and increase participation in sports and fitness.

SFIA has focused much of its efforts on legislation to:

INCREASE PARTICIPATION

Capture the Economic Impact of Youth Sports

Participation in team sports continues to rise and the economic footprint of youth sports is large and growing. SFIA is working with Congress to launch an annual BEA study on the economic impact of youth sports to add to our messaging in promoting youth sports policies.

The gross economic output of Outdoor Recreation was $1.1 trillion in 2022, according to an annual study performed by the Bureau of Economic Analysis (BEA). Outdoor recreation is not in every community throughout the U.S., but youth sports are, and we want to capture that information.

Youth sports are far more than registration fees and field/court/rink rentals; referees and administrative staff at facilities and leagues, coaches, clinics, camps, and sports equipment sales all directly contribute to the youth sports economy – but so does development around sports facilities. Tournaments fill hotel rooms and generate revenue in the community. Fuel stations, grocery and convenience stores, fast food, and chain pharmacies pop up around facilities, and concessions and sports shops in the facility create jobs and contribute to the local economy.

The BEA Youth Sports Economic Impact study will not be available until 2026 at the earliest.

Promote Healthy Lifestyles Via Increased Activity and Access to Facilities

The pandemic highlighted the mental and physical health benefits of physical activity, and communities with children not able to participate on teams due to lack of sports facilities had worse outcomes. Ensuring greater access to facilities will lead to better health and lower future U.S. outlays to treat preventable chronic conditions and mental health problems.

SFIA is working with Congress to increase investments in youth sports infrastructure. Legislation to expand the use of Economic Development Assistance (EDA) funds to include youth sports infrastructure has bipartisan leadership in the House. SFIA is seeking a Republican to join our Democratic Senate lead.

Under the bill, urban and rural communities with a high incidence of substance abuse or violent crime, and lacking sports facilities, would be targeted for new investments in sports and recreation infrastructure. The Secretary of Education would award EDA grants; with 40 percent going to schools and the balance split between non-profits, cities/political subdivisions, and economic development districts.

SFIA has launched a state-of-the-art Sports & Recreation Project Database to give our members advanced notice of new investments in Sports & Recreation Infrastructure. The database uses AI to review up to 400,000 pages of minutes and agendas weekly from local government, council, committee, and board meetings. The database captures the information at the earliest stage of the project, often before the RFP is written, giving SFIA members a competitive advantage.

The Sports and Recreation Project database is searchable by sport, product, facility type, state, and date for customized reports that focus on projects with the most relevance to a business. Database users will receive daily e-mails on new investments to provide the latest info and keep users ahead of their competition.

New youth sports facilities will address the access barrier to youth sports, adult fitness and recreation, and the Personal Health Investment Today (PHIT) Act will lower the cost barrier. PHIT expands Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), and other pre-tax medical accounts to cover activity expenses as a form of prevention. An independent commission reviewing the U.S. Olympic Committee publicly pressed Congress to pass PHIT earlier this month.

PHIT would lower family and consumer costs for youth sports, health clubs/fitness centers, and adult recreation by allowing payment using pre-tax dollars. Allowable expenses include registrations, membership dues, subscription fees, instruction, clinics, camps, tournaments, and equipment used exclusively to participate in sports, recreation, and fitness. Apparel and footwear that can be worn casually and travel and accommodations would not be eligible for PHIT savings.

PHIT has support from more than 80 Republicans and Democrats in Congress, including 15 from the tax-writing Ways & Means Committee which has jurisdiction for the bill. PHIT Champions are seeking an appropriate legislative vehicle to attach PHIT and move it through Congress.

TARIFF RELIEF

Renew Tariff Relief to Lower the Cost of Getting Products to Market

An estimated 100 million dollars in tariff relief on industry products awaits Congressional action, two years after the Miscellaneous Tariff Bill (MTB) and Generalized System of Preferences (GSP) lapsed at the end of 2020. SFIA has more than 80 MTB petitions on industry products fully vetted by the US International Trade Commission and recommended for inclusion in the MTB. MTB tariff relief is capped at $500,000 per petition for up to $40 million in tariff relief on industry products. Gloves, equipment bags, backpacks, and other sports equipment enter the U.S. duty-free if made in a GSP-eligible country, avoiding tariffs ranging from 3.0% to 17.6%.

Environmental issues are a sticking point, but the U.S. included provisions in the USMCA trade agreement that could be adopted for MTB and GSP to address those concerns. The bigger obstacle is Democrats desire to add Trade Adjustment Assistance (TAA) to help workers displaced by jobs moving overseas to MTB/GSP renewal legislation; Republicans counter with a demand to give the President Trade Promotion Authority (TPA) to negotiate free trade agreements without Congressional interference. TAA and TPA are policy differences that can be worked on outside of MTB/GSP, but to date, these have languished in Congress and impeded progress on tariff relief.

SFIA continues to press Congress for the renewal of these traditionally bipartisan, non-controversial tariff relief bills. A March advocacy day on Tariff Relief was well received – Congress is sympathetic and seeking a way to break the impasse to move legislation to renew GSP/MTB.

U.S. Trade Representative Katherine Tai has repeatedly indicated the Section 301 Tariffs on products made in China serve a purpose and give the U.S. leverage in future trade negotiations. Ambassador Tai points to the tariffs leading to increased sourcing outside of China, including back to the U.S., but there is little evidence to support that claim. China’s failure to meet all the terms of the Phase 1 trade deal provides justification for continuing tariffs of up to 25 percent on imports, although Section 301 tariffs on most consumer goods are 7.5 percent. The Section 301 tariffs are in addition to other tariffs on imported products and inputs, putting the total tariff on many Chinese imports above 10 percent.

While it is unlikely that Section 301 Tariffs will be dropped anytime soon, SFIA has pushed for a required U.S. Trade Representative four-year review of the Chinese tariffs. The review will report on the impact of the tariffs, China’s compliance with the terms of the Phase 1 agreement, and most importantly the Section 301 Tariff Exclusion process.

The initial USTR Exclusion process provided relief for roughly a third of requests on Lists 1 and 2, covering steel, aluminum, large consumer appliances, and industrial products, but, only five percent of Exclusion requests were approved for consumer products on Lists 3 and 4A. A General Accountability Office (GAO) report on the Exclusion process found it to be seriously flawed and unfair. GAO recommended re-opening the exclusion process with greater transparency to ensure fair consideration of requests for relief. The USTR review will provide insight into the government’s position on reopening a more transparent exclusion process that offers SFIA members an opportunity to seek relief from China tariffs.

Supply chains

Ensure Reliable Supply Chains to Ensure Timely Delivery of Products

The reliable movement of goods from factories into the stream of commerce is critical to meeting consumer demand and limiting spikes in costs to businesses and consumers. Following the supply chain crisis from the pandemic, Congress enacted the Ocean Shipping Reform Act of 2022 to address rising fees and challenges to the timely delivery of products.

The new laws have reduced fees and led to more reliable shipments of products, but recent global conflicts have disrupted the flow of goods. Shippers have opted to avoid the Suez Canal due to hostilities off the coast of Yemen targeting ships and the longer shipping routes have disrupted the flow of commerce. It is estimated that $80 billion in cargo has been diverted due to hostilities in Red Sea shipping lanes. New routes take ships around the Cape of Good Horn and create greater reliance on West Coast Ports. The new routes have driven up shipping costs due to increased traffic at certain ports that lack the equipment necessary to process the increased volume efficiently.

SFIA requested safe and secure maritime commerce in the Red Sea in a February letter encouraging countries to commit to a multinational security initiative. Twenty-three countries are currently participating in Operation Prosperity Guardian to keep Red Sea shipping lanes safe, and the Suez Canal a viable shipping option. SFIA and other concerned parties stress the need to protect the 30 percent of global trade flowing through the Red Sea and Suez Canal from interference and attacks.

The current labor contract for port workers from Maine to Texas expires on September 30. Negotiations are ongoing between the International Longshoreman’s Association (ILA) and the United States Maritime Alliance (USMA) on a new contract to avoid any disruptions in the flow of commerce to East Coast Ports. The ILA has set a May 17 deadline for local contracts to be agreed upon to allow for negotiations on an overall Master contract prior to the September deadline. To date, only the ports of New York/New Jersey and Baltimore have reached tentative local agreements.

ILA is seeking a more generous contract than West Coast Ports received and pointed to the 40 percent increase in wages and benefits in the Great Lakes District contract as a target. East Coast Port worker unions also object to increased automation and want exclusive port contracts for its workers. Historically, East Coast and Gulf Coast Ports have been less aggressive on strikes and slowdowns during contract negotiations due to the royalties longshoremen receive based on the tonnage of cargo processed. Any disruptions that divert cargo to the West Coast would be bad for East Coast port workers.

INTELLECTUAL PROPERTY

Combat the Theft of Intellectual Property

At the January PGA Show, the Deputy Director of the U.S. Patent & Trademark Office identified SFIA’s U.S. Golf Manufacturers Council anti-counterfeiting program as a model for U.S. businesses seeking to curb the flow of fake products from China. The USGMC program addresses the counterfeit product issue at the root of the problem, focusing its efforts on the ground in China. USGMC identifies fake products, determines the source, and then works with local law enforcement to take down the counterfeiters, seize fake products, and close the production facility. Listings of fake products are removed from online marketplaces and websites dedicated to the sale of fake golf equipment are shut down.

Companies engaged in the production and distribution of fake golf equipment are fined and required to pay damages. Individuals are sentenced to jail time and assessed fines for golf IPR violations. Since the inception of the USGMC anti-counterfeiting program, an estimated 2,000,000 pieces of equipment have been seized. The raids have resulted in over $118,000,000 in damages awarded, more than 100 convictions, and almost $3,000,000 in fines. Only fake products containing marks and branding of the golf manufacturers paying for the program can be seized; fake golf products from non-participating golf companies are left on the factory/warehouse/distribution center floor.

With the implementation of Section 301 Tariffs on Chinese imports, companies based in China have turned to direct shipments to consumers to avoid CBP inspections and applicable tariffs. ‘De Minimis’ shipments with a value of $800 or less enter the U.S. without CBP inspection for forced labor or counterfeit products and appropriate tariffs are not collected. More than two million packages a day enter the U.S. under the De Minimis exemption and the total value of de minimis shipments has increased from $40 million in 2012 to $67 billion in 2022. Counterfeiters in China have utilized the de minimis exemption to gain access to the U.S. market without CBP inspections.

SFIA applauds Senators Sherrod Brown’s (D-OH) and Rick Scott’s (R-FL) February 23rd letter to President Biden requesting he “utilize broad executive authorities to end duty-free treatment for Section 321 de minimis e-commerce shipments that are facilitating the import of illegal products, goods produced with forced labor, and other contraband to the detriment of U.S. manufacturers, workers, and communities.” SFIA supports the Import Security & Fairness Act to prohibit the use of de minimis for products shipped from non-market economies on the USTR’s priority watch list. CBP would be given additional authority to collect more information on De Minimis shipments and ban bad actors.

REGULATION

Ensure Reasonable Regulation and Compliance with Laws

SFIA supports efforts to stem the flow of products containing illegally harvested wood from entering the stream of commerce. The Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) enforces the Lacey Act to regulate the importation of plant products, including wood and other materials, to ensure compliance with U.S. policies on the source of wood in finished products.

Importers must provide scientific name, value, quantity, and country of harvest to certify products contain no illegally harvested wood. APHIS provides two options for filing declarations online: The Automated Commercial Environment (ACE) and the Lacey Act Web Governance System (LAWGS). More information and guidance on declarations can be found on the APHIS website.

Perfluoroalkyl and polyflouroakyl (PFAS) substances have been found to adversely affect health. Lower fertility, development delays, behavioral changes in children, and potentially an increased risk of certain cancers have all been linked to PFAS chemicals. PFAS substances are used in water and stain-resistant coatings found in athletic apparel and footwear, some swim products, and certain sports and fitness products.

The Environmental Protection Agency (EPA) published a new rule requiring any person that manufactures (including imports) or has manufactured (including imported) PFAS or products containing PFAS chemicals in any year since January 1, 2011, to electronically report information regarding PFAS uses, production volumes, disposal, exposures, and hazards.

Any entities, including small entities, that have manufactured or imported products containing PFAS will have 18 months to report PFAS data to EPA. Small manufacturers (as defined at 40 CFR 704.3) whose reporting obligations under this rule are exclusively from article imports will have 24 months to report PFAS data to EPA.

Non-compliant PFAS products warehoused in 2024 cannot be sold in the U.S. beginning January 1, 2025.

Ten States have PFAS restrictions, with California and New York being the most aggressive. California has announced an expansion of the PFAS list of banned substances in consumer products to include Perfluorooctanoic acid (PFOA), Perfluorooctanesulfonic acid (PFOS), and Perfluorononanioc acid (PFNA) to the list of banned chemicals. Proposition 65 mandates warning labels on consumer products containing certain chemicals. The new California PFAS restrictions go into effect on January 1, 2025. New York has banned apparel with intentionally added PFAS beginning January 1, 2025, and outdoor apparel for severe wet conditions starting January 1, 2028.

SFIA members making apparel & footwear have the highest industry exposure.

For more information or for questions on SFIA public policy, please contact Bill Sells.

Washington, D.C. (February 15, 2024): A Congressional Research Service (CRS) report recommends Congress engage with the USTR to develop and implement guidelines on the grant exclusion process for tariffs applied to imports of Chinese products under Section 301 of the Trade Act of 1974. In the coming months, USTR hopes to complete a required four-year review of the tariffs currently in place on hundreds of billions of dollars worth of Chinese goods. The CRS report suggests Congress “could potentially promote transparency, consistency, and proper application of standards in reviewing requests, thereby helping to ensure that the USTR carries out Section 301 objectives as prescribed by Congress.”

Lawmakers have offered legislation to amend Section 301 and explored creating or restructuring the exclusion process to make it more efficient and transparent during hearings and shared their position with the USTR. Congress has expressed interest in “recalibrating” the tariffs to align better with U.S. economic and strategic priorities, some prefer a partial removal of the tariffs on consumer goods to help U.S. companies and lower consumer costs. Others believe the tariffs provide leverage in future U.S.-China trade negotiations and should be preserved to promote domestic manufacturing and supply chain stability.

A letter from U.S. Trade Representative Tai to the House Select Committee on Strategic Competition between the U.S. and the Chinese Communist Party suggests the USTR will consider other options available to make the tariffs “more strategic” while remaining sensitive to the incentives the tariffs create. Ambassador Tai pointed out that the Section 301 tariffs promoted diversity in supply chains as companies have moved out of China which helped protect them from ‘forced technology transfers’ in China.

USTR acknowledged that Chinese firms have moved some operations away from China to avoid the tariffs and that “existing rules of origin” left openings for those Chinese firms to benefit from preferential MFN tariff treatment and Free Trade Agreements, thereby avoiding Section 301 tariffs. Ambassador Tai noted the challenges presented by easy access to the U.S. market for goods from key trading partners and that the Administration will work with Congress to evaluate these challenges and address them.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

(Friday, February 9) — The U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) enforces the Lacey Act to regulate the importation of plant products, including wood and other materials. Products containing illegally harvested wood are subject to seizure upon entry into the U.S. and individuals importing these products can be incarcerated and subject to financial penalties.

Importers of wood products are required to file a declaration identifying the scientific name, value, quantity, and country of harvest to determine if the wood was legally harvested. Importers must provide certification on the origin of wood and third-party certification or verification cannot be used to prove the legality of timber harvested. The Lacey Act does not apply to composite wood used in fitness benches and other products.

The Lacey Act is in the final expansion stage and all imports of “plant” products, including wood products, must now be declared upon entry into the U.S. Non-compliance with the Lacey Act is a felony offense with violators subject to fines and imprisonment.

APHIS provides two options for filing declarations online: The Automated Commercial Environment (ACE), and the Lacey Act Web Governance System (LAWGS). More information and guidance on declarations can be found on the APHIS website.

An individual or company can be charged with a misdemeanor offense or civil penalties for failing to exercise “due care” in determining that the wood used in products was harvested legally. ‘Due care’ is defined as “The degree of care which a reasonably prudent person would exercise under the same or similar circumstance.” A 2021 violation of the Lacey Act for importing illegally harvested wood led to $200,000 in restitution to the country of origin and a fine.

The government does not have to establish any level of knowledge on the part of the person regarding the illegal nature of the product to forfeit it: civil forfeiture of illegally harvested wood products may be imposed on a strict liability basis.

APHIS is offering free training for Lacey Act compliance through the International Wood Products Association (IWPA). More information on free Lacey Act compliance training can be found here.

For questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

(Wednesday, December 20) — In our continuing effort to secure tariff relief on sporting goods and fitness products, SFIA joined almost 200 business organizations asking Congress to urge USTR to immediately conclude the required four-year review of the Section 301 Tariffs. The review has taken more than 18 months, and the four-year deadline has passed to submit their findings to Congress. Business interests also expressed concern over the lack of a transparent exclusion process as recommended by the General Accountability Office (GAO) after its investigation found the initial exclusion process to be seriously flawed and unfair.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

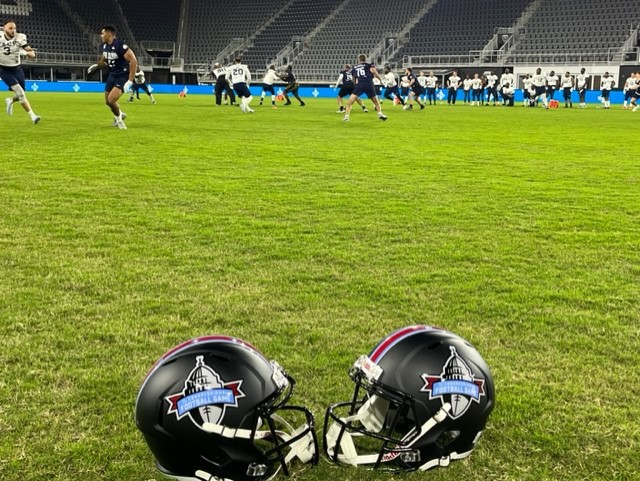

The U.S. Capitol Police takes down Congress ‘Mean Machine’ 16-14 in Charity Football Game

(Thursday, September 28): The annual Congressional Football Game for Charity was a nail-biter with the U.S. Capitol Police team scoring in the final minute for a two-point victory. Mean Machine captains Congressman Jimmy Panetta (D-CA) and Rick Crawford (R-AR) exhibited great leadership on and off the field to make this game a huge success, raising $500,000 for charity.

SFIA thanks Nike, Shock Doctor, Wilson, Riddell, and Saranac for supporting the game with equipment and uniform donations to the teams.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

(Wednesday, September 27): The 2023 Congressional Football Game will take place on Thursday, September 28. The 14th annual game will take place at Audi Field in Washington, DC.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

(Wednesday, September 20) It has been more than two years since two important tariff relief programs lapsed. The Generalized System of Preferences (GSP) and the Miscellaneous Tariff Bill (MTB) provide more than $100 million in tariff relief on sport and fitness products imported into the U.S. To qualify for tariff exemption under the GSP, a product must be made in one of more than 110 GSP-eligible countries with developing economies. Products currently made in GSP countries include backpacks, sports bags, golf bags/equipment, sports gloves, racquets, volleyballs, basketballs, and fitness consoles. MTB-eligible products must be vetted by the ITA to ensure they are not made in the U.S. SFIA had 82 MTB petitions approved by the ITA in the last vetting, for up to $41 million in tariff relief.

SFIA is pleased to report there is progress on both programs. The House Ways & Means Subcommittee held a hearing today on ways to improve GSP and included both GSP reauthorization and MTB renewal in the discussion. Please find the opening statement of Ways & Means Chairman Jason Smith here. SFIA will continue to press for the passage of legislation to provide tariff relief to lower the cost of getting our members’ products to market.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].