Washington, D.C. (July 9, 2024): Youth sports is a sleeping giant in Washington, but that is about to change. SFIA applauds Congressman Chuck Fleischmann (R-TN) on securing language in the Commerce Department Appropriations for a comprehensive study on the economic impact of youth sports in America (page 16). Layering the economic data on top of the social and health benefits of youth sports will move policies through Congress.

Everyone in Congress supports active kids and youth sports for a variety of social and health reasons, yet many policies to address the cost and access barriers remain stalled. The pandemic disrupted youth sports like never before and the physical and mental health fallout is well documented. The benefits of team sports and activity for children have never been more evident; Congress needs to help families get kids in the game.

SFIA identified the Commerce Department’s Bureau of Economic Analysis (BEA) as the perfect government agency to collect data from the Departments of Education, Labor, Health & Human Services, and Interior on the total economic impact of youth sports in the U.S. SFIA is the gold-standard for industry research and this new government study on the economic impact of youth sports will be a valuable resource for the industry and complement SFIA’s ongoing research.

Any new government study needs funding and SFIA found the right champion in Congressman Fleischmann. The Congressman was SFIA’s top choice; an athlete, playing on the Congressional Baseball, Football, and Basketball teams, a regular in the House gym, and an Appropriations Subcommittee Chairman. The Congressman took on the challenge of funding the study with passion and commitment and delivered the language in the Commerce Appropriations bill to launch the study:

Youth Sports Economic Impact Study — The Committee directs the Secretary to report to the Committee, no later than 90 days after the enactment of this Act, on the feasibility of entering into a joint memorandum with the Secretary of Education, the Secretary of the Interior, the Secretary of Health and Human Services, and Secretary of Labor to assess the youth fitness and sports economy of the United States by identifying the total revenue generated from youth fitness and sports businesses and facilities on a national and State level; the total jobs created by youth fitness and sports businesses and facilities; and the total dollar value of the youth fitness and sports economy.

The study will be funded in 2025 with the first report released in 2026. A similar BEA study for Outdoor Recreation found a total economic output of $1.1 trillion in 2023 or 2.4 percent of U.S. GDP. SFIA believes the youth sports figures will be even bigger. Youth sports exist in every community in America and have more participants through school, community, and club sports programs than outdoor recreation.

Active Americans are healthier and spend less on preventable medical conditions; capturing the economic impact of activity in America will boost federal investments in youth sports and adult fitness. SFIA thanks Congressman Fleischmann for his vision and leadership.

For more information, please contact Bill Sells, SFIA SVP for Government & Public Affairs, at [email protected].

Washington, D.C. (June 18, 2024): “The threat of a coast-wide strike on October 1, 2024, is becoming more likely as U.S. Maritime Alliance (USMX) and its member companies continue to drag their feet,” warned International Longshoremen’s Association (ILA) President Harold Daggett

This ominous message from the ILA was included in an ILA Press Release last week highlighting the record profits of shipping companies and union concerns over automation as they negotiate a new Master Contract for ports from Maine to Texas that seeks greater distribution of shipping revenues to dock workers.

Technological advances have led to increased efficiencies via automated tracking of cargo and increased use of technology to perform clerical tasks. Both advancements are good for shipping but a threat to Union jobs. In addition, Unions are upset that the tech support jobs created by automation are not union jobs and they should be since work is performed around the ports.

The ILA walked away from the negotiating table on June 10 over an automation issue at the Port of Mobile. Union leaders do not believe the USMX is negotiating in good faith as shippers and ports explore ways to circumvent the Union’s traditional roles, including using technological solutions to perform basic clerical tasks that eliminate Union jobs.

SFIA responded to this development with a letter to President Biden and key cabinet secretaries asking for the government to intervene to ensure fragile supply chains are not artificially disrupted by a labor strike at ports from Maine to Texas. The resiliency of supply chains has been tested recently by Red Sea hostilities, the Ukraine war, S. China Sea tensions, and the recent drought in the Panama Canal; an East Cost Port Labor strike as we move into the peak shipping season would present a huge challenge to supply chains and lead to diversion of cargo to West Coast ports.

The Unions point out that A.P. Moeller-Maersk had $82 billion in revenue in FY 2022, a 50 percent increase over FY 2021. Similarly, Mediterranean Shipping Company had revenues of $28.2 Billion, COSCO saw revenues jump from $51.67 billion in FY 21 to $63.2 billion in FY 2022 and APM Terminals saw a nine percent growth in revenues to $4.4 billion in FY 22. All these companies’ interests are represented by USMX on behalf of the ports.

The current ILA contract with East and Gulf Coast Ports expires on September 30th, five weeks from Election Day. Labor is driving a hard bargain, but East and Gulf Coast Port unions use a compensation formula that includes the volume of cargo moved through their port. A strike would have a direct impact on Union wages which will put pressure on Union leadership to reach a new labor agreement. If talks drag on and a strike looks more imminent, expect the Administration to step in to avoid a supply chain crisis so close to the Election but there are no guarantees with Unions playing hardball in sharing shipper and port finances.

For more information, please contact Bill Sells, SFIA SVP for Government & Public Affairs, at [email protected]

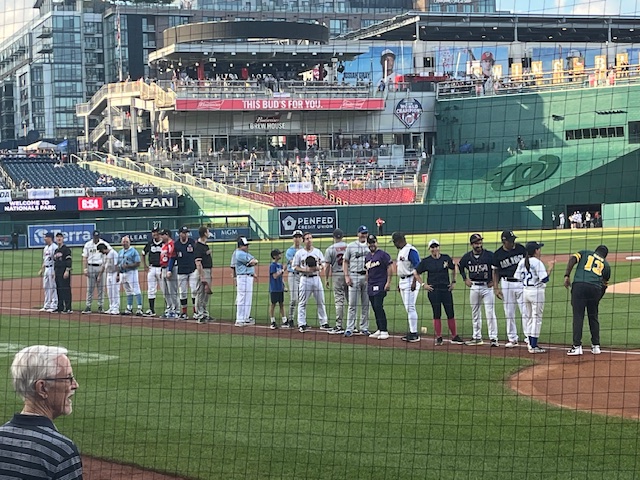

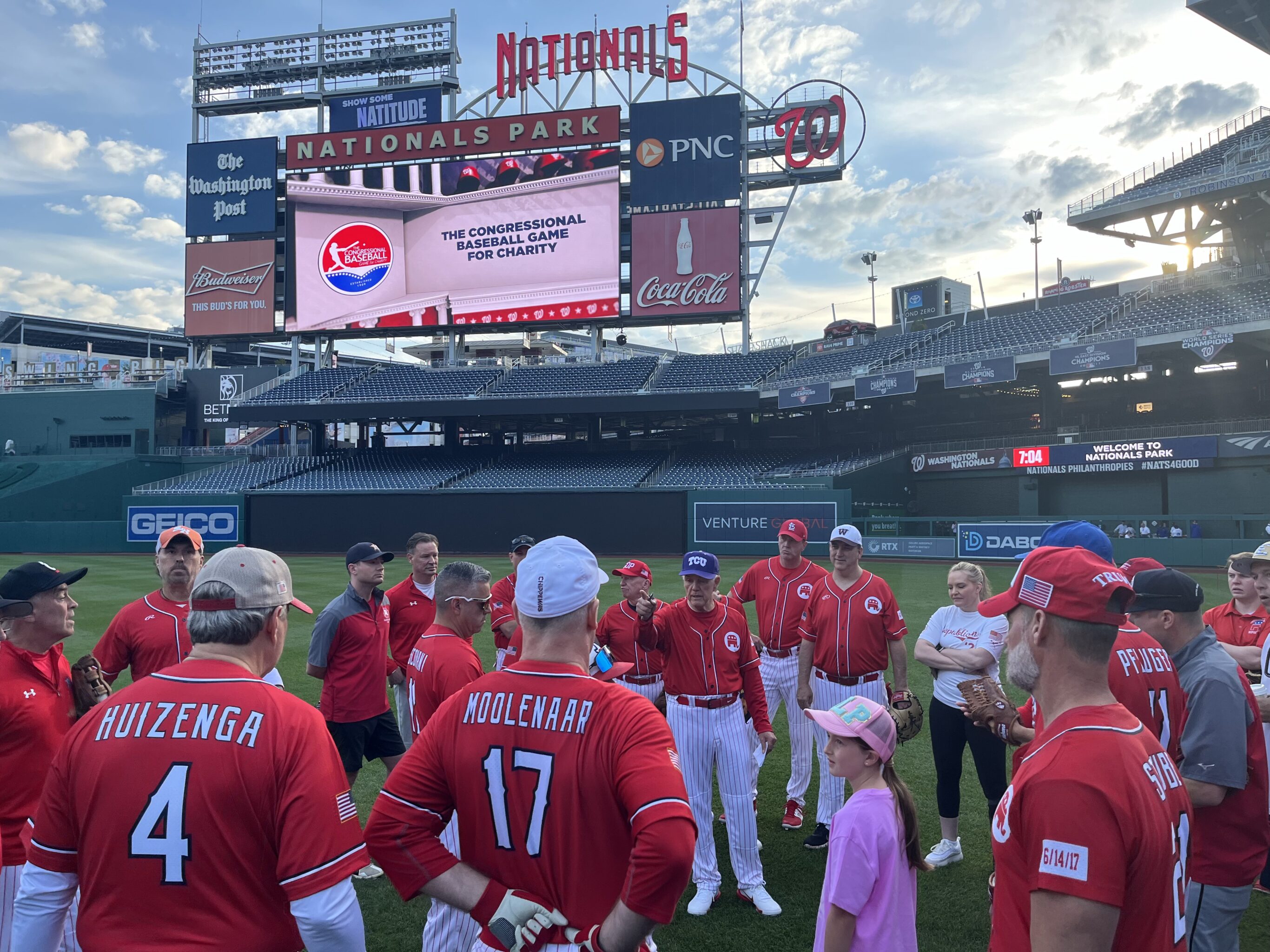

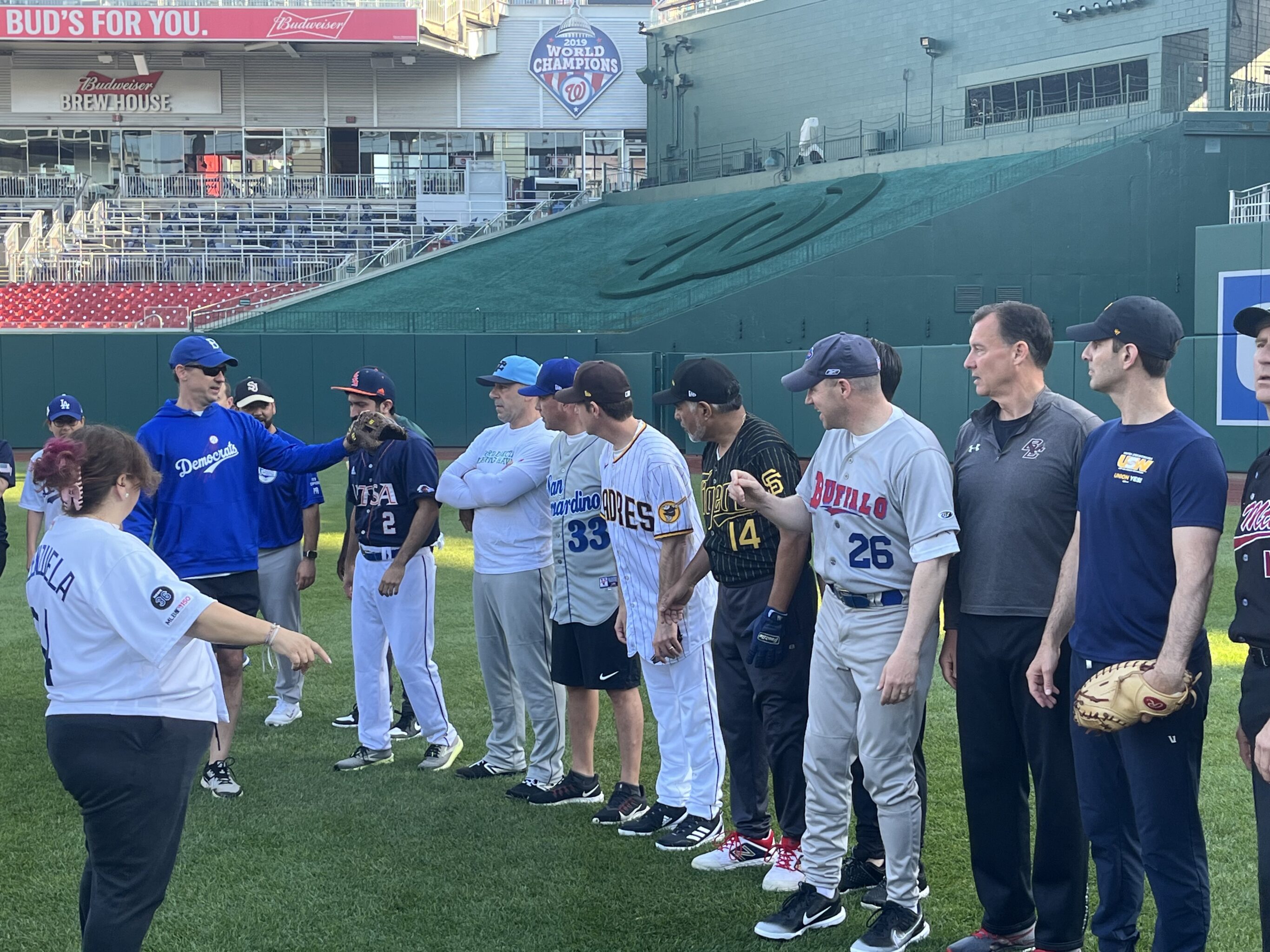

(Thursday, June 13) The 2024 Congressional Baseball Game tee’d up all kinds of action yesterday at Nationals Park in Washington D.C.!

The Republicans won 31-11, a blowout as expected with the Democrat pitchers struggling with control, and Republican pitcher Greg Steube (R-FL) was strong on the mound and at plate. The Republicans had better hitters, and there were lots of steals and errors on both sides. But the important part – the game raised $2.2 million for charity.

Thank you to SFIA Members DeMarini, Rawlings, Easton, Wilson, Marucci, and Franklin for providing equipment and to Champro who provided polos for the coaches.

Check out some pics below from the big day!

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

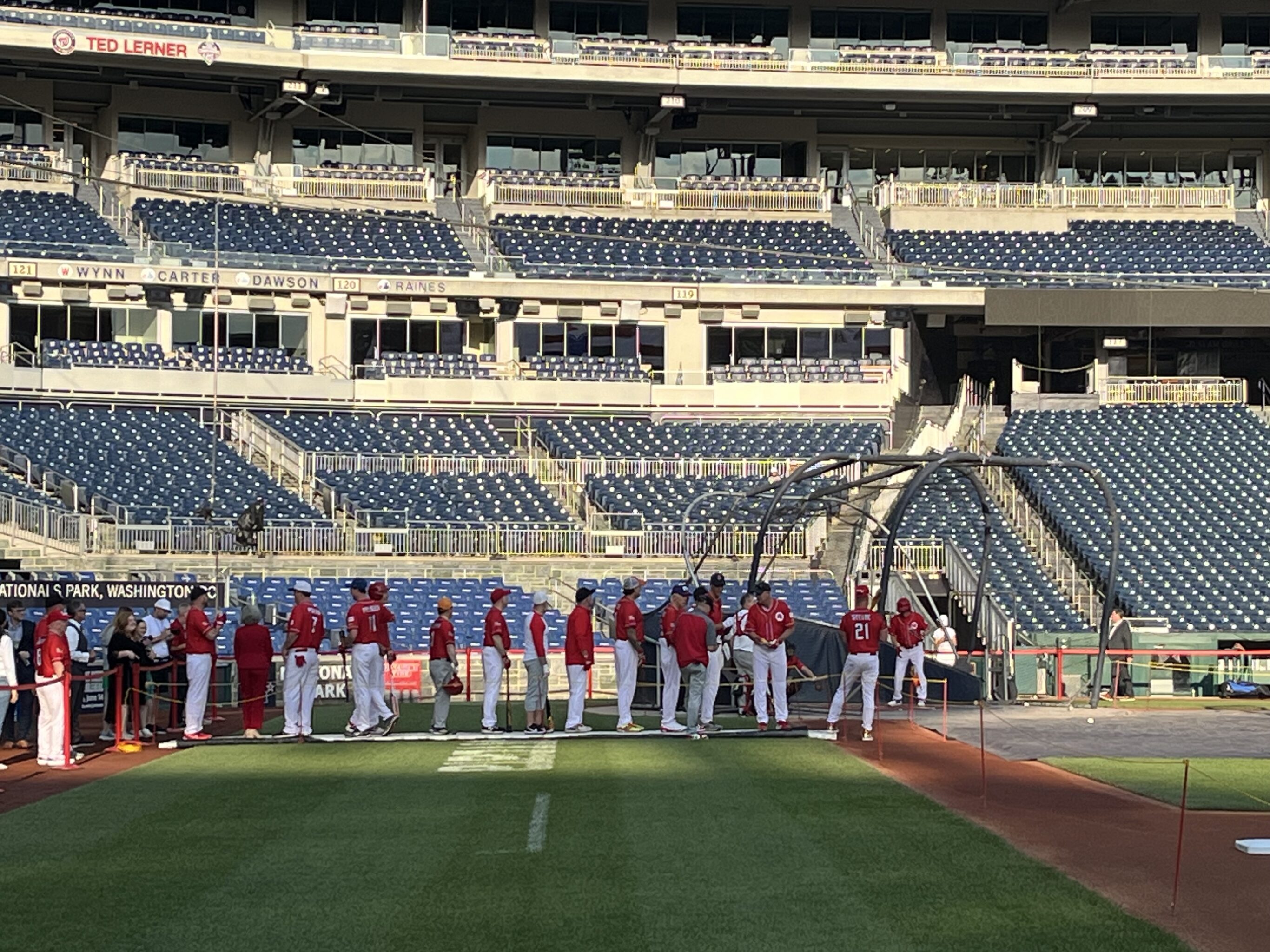

SFIA members Franklin Sports, Marucci, Wilson/DeMarini, and Rawlings/Easton are supporting the Congressional Baseball and Softball games with equipment donations! Below you can find a sneak peek of the practices – leading up to the games on June 12 (baseball) and June 26 (softball)!

The games will raise collectively close to $2 million for charity. Funds from the Congressional Softball game go to the Young Survivors Coalition to help breast cancer survivors. The Congressional Baseball game money is split among many charities – you can find the beneficiaries on the website.

Thank you to our SFIA Members who help support the cause!

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (May 23, 2024): In an ironic twist, the office of the U.S. Trade Representative shared they would open a portal for comments on the impact of Section 301 Tariffs on businesses in the same Federal Register notice they announced new tariffs of 25 to 100 percent on a long list of products.

None of the new tariffs target sports or fitness equipment directly, but tariffs on aluminum, steel, and iron would rise to 25 percent. Companies with products containing steel, aluminum, or iron from China are encouraged to review Annex A of the Federal Register notice to determine their new tariff exposure.

With the announcement of new tariffs and the USTR’s 4-year review on the impact of Section 301 Tariffs limiting the exclusion process to machinery used in domestic manufacturing, there is no avenue to Section 301 Tariff Relief at this time. This is disappointing following the General Accountability Office (GAO) review of the Section 301 Exclusion process for consumer goods on lists 3 & 4A, which found the process seriously flawed and recommended a new fair and transparent exclusion process for consumer goods.

The USTR comment portal offers an opportunity to share the impact of the current tariffs on your business with USTR, what the new tariffs mean to your business, and press for a new fair and transparent exclusion process for consumer goods. Please find questions USTR posted for comment consideration here. The 30-day comment period opens on May 29 and closes June 28. Comments can be submitted using this link https://comments.ustr.gov/s/ under the heading “Request for Comments: Proposed Modifications to the Section 301 Actions and Proposed Exclusion Process” (docket number USTR–2024–0007).

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (May 21, 2024): The U.S. Trade Representative (USTR) released an overdue 4-year review on the impact of Section 301 Tariffs. The report found that China has made progress, but has not met the terms of the Phase One agreement and the tariffs will remain in place. It was hoped the report would offer a pathway to exclusions for consumer goods on List 3 & 4A, but only machinery equipment used in domestic manufacturing will be eligible for new exclusions.

Specifically, the report noted China continues to abuse tariff transfer policies and that U.S. Customs & Border Protection (CBP) needs more resources to enforce Section 301 violations. The U.S.T.R. also recommended increased cooperation between the public and private sectors to combat state-sponsored IP theft and the need to diversify supply chains for improved resiliency.

“The report is very disappointing,” said Bill Sells, SFIA SVP for Government and Public Affairs. “The goal of the tariffs was to punish China for IP violations and unfair trade practices and drive manufacturing jobs back to the U.S. The Section 301 tariffs have not accomplished any of these goals, and are nothing more than a tax that is ultimately paid by consumers. It is very unfortunate that we understand the importance of active lifestyles to overall health like never before, but we are artificially raising the cost barrier to healthier lives.”

In addition to not re-opening a fair and transparent exclusion process as recommended by the General Accountability Office (GAO), the President announced high tariffs on electric vehicles, batteries, and solar panels made in China. Former President Trump has announced his intention to raise and expand Section 301 Tariffs if elected, meaning the trade war with China will continue.

To facilitate production outside of China, the House Ways & Means Committee passed legislation to re-authorize the Generalized System of Preferences (GSP) and modify the Di Minimis exemption. GSP eliminates U.S. tariffs on products sourced in 119 countries with developing economies. Di minimis reform would restrict the use of direct-to-consumer low-dollar shipments from China to stem the flow of fake products entering the U.S. without CBP inspection. Both bills await a House floor vote.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Up to $40 Million in Tariff Relief on Sports & Fitness Products Previously Approved

Washington, D.C. (May 15, 2024): More than three years after MTB tariff relief lapsed, Congress is moving to renew this vital program. The House Ways & Means Trade Subcommittee Chairman Adrian Smith (R-NE) introduced the “Miscellaneous Tariff Bill Reform Act” on May 14th with support from 17 House Ways & Means members.

“Congress must renew this historically bipartisan legislation which unanimously passed out of the Ways & Means Committee in 2016,” stated Ways & Means Trade Subcommittee Chairman, Adrian Smith. “Fighting for American workers and industry demands we do everything we can to make U.S.-manufactured goods more competitive in both domestic and international markets. This legislation will deliver input cost relief to American producers, in turn benefiting consumers worldwide.”

The proposed MTB bill would offer duty-free treatment through 2025 for products recommended by U.S. International Trade Commission, after vetting petitions, for inclusion in the MTB bill. MTB relief would be retroactive from January 1, 2021. The bill would align with U.S. Trade policy toward China by excluding finished products subject to Section 301 duties but allow U.S. manufacturers duty-free access to parts and components. The bill would reauthorize the USITC-initiated processes for vetting future MTB relief petitions to create new tariff relief opportunities for domestic manufacturers on inputs not made in the U.S.

The introduction of the MTB Reform Act is a long overdue first step in the process. House Republicans will now look to move the MTB Reform Act through the Ways & Means Committee and then bring it to the House floor for a vote. No timetable has been set for Ways & Means consideration. While MTB has always been bipartisan, the heat of an election year has kept Democrats off this bill as they seek to build support with organized labor leading up to the fall elections. With Democrats controlling the Senate, a compromise will be necessary to get it through the Senate and to the President’s desk in 2024.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (May 15, 2024): President Biden announced new tariffs on Chinese imports of aluminum, steel, semiconductors, batteries, and electric vehicles in an effort to protect investments in those domestic industries. The President did not address the required four-year review on the effectiveness of the China tariffs in achieving U.S. policy objectives and the re-opening of a more transparent exclusion process as recommended by the General Accountability Office.

The White House release outlined tariff increases to 25 percent beginning in 2024 for battery parts (non-lithium ion), lithium-ion EV batteries, ship-to-shore cranes, critical minerals, and steel & aluminum; electric vehicle tariffs will rise to 100 percent and solar cells to 50 percent. Tariffs on semiconductors will increase to 50 percent in 2025 and in 2026, tariffs on permanent magnets, natural graphite, and lithium-ion non-EV batteries will grow to 25 percent.

The U.S. Trade Representative (USTR) will issue a notice on the comment process and an exclusion process for machinery used in domestic manufacturing. USTR referenced the required four-year review on the effectiveness of tariffs in the announcement and relied on some of the findings to propose higher tariffs on certain products, but provided no timeline for the release of the report and re-opening a new transparent exclusion process.

SFIA will continue pressing USTR to release the report and re-open a new fair and transparent exclusion process. SFIA will offer assistance to any companies seeking help with Exclusion petitions.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (May 9, 2024): The American Golf Industry Coalition (AGIC) ascended on Capitol Hill on May 9 to promote the PHIT Act on National Golf Day (NGD). SFIA’s U.S. Golf Manufacturers Council is a leader in the AGIC and USGMC Chairman, Rawleigh Grove, joined the lead group on NGD. In addition to PHIT, AGIC also requested funding for Turfgrass research and the removal of golf courses as ineligible for disaster relief. More than 200 people participated in meetings with Congress.

Bill Sells, SFIA SVP for Government & Public Affairs joined a group from Arizona for a successful day promoting golf for health and the PHIT Act. As a lifelong sport that promotes healthy activity, golf is a great example of how the PHIT Act will lower costs to increase participation and improve health in America. The group pointed out the hypocrisy in the IRS’s announcement that medically prescribed activities would be eligible for HSA reimbursement, but not voluntary physical activity expenses that keep you out of the doctor’s office.

NGD was a good day for the PHIT Act, adding new co-sponsors to give PHIT close to 100 bipartisan co-sponsors in Congress, including more than half of the House Ways & Means Committee. PHIT champions continue to press Congressional leadership to move PHIT in a health or tax package in 2024.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].

Washington, D.C. (May 14, 2024): On May 14, Bill Sells, SFIA SVP of Government & Public Affairs, joined the SHOP SAFE coalition on Capitol Hill to promote legislation requiring online sellers to follow the same rules as brick-and-mortar retailers before listing products for sale. The growth of the online marketplace has led to a significant increase in counterfeit sales of sports equipment & fitness products. The National Association of Manufacturers puts the total revenue lost due to counterfeits at $130 billion annually and is still growing as more consumers make online purchases.

The SHOP SAFE Act is bipartisan legislation to reduce online counterfeit sales by requiring e-commerce websites to follow the same requirements as brick-and-mortar retailers in determining the authenticity of a product sold on their platform. Under the legislation, an online seller would be held liable for any harm caused by a fake product sold on their site. The SHOP SAFE Act is supported by a broad coalition of interests. The National Association of Manufacturers, Online Pharmacies, Home Appliances, Toys, Auto-Parts, Childrenswear, and Apparel & Footwear industries joined SFIA in SHOP SAFE meetings with Congress on May 14.

For more information or for questions, please contact Bill Sells, SVP, Government & Public Affairs, at [email protected].